Bowery Farming’s $70M Georgia vertical farm heads to liquidation as startup’s collapse triggers nationwide sell-offs

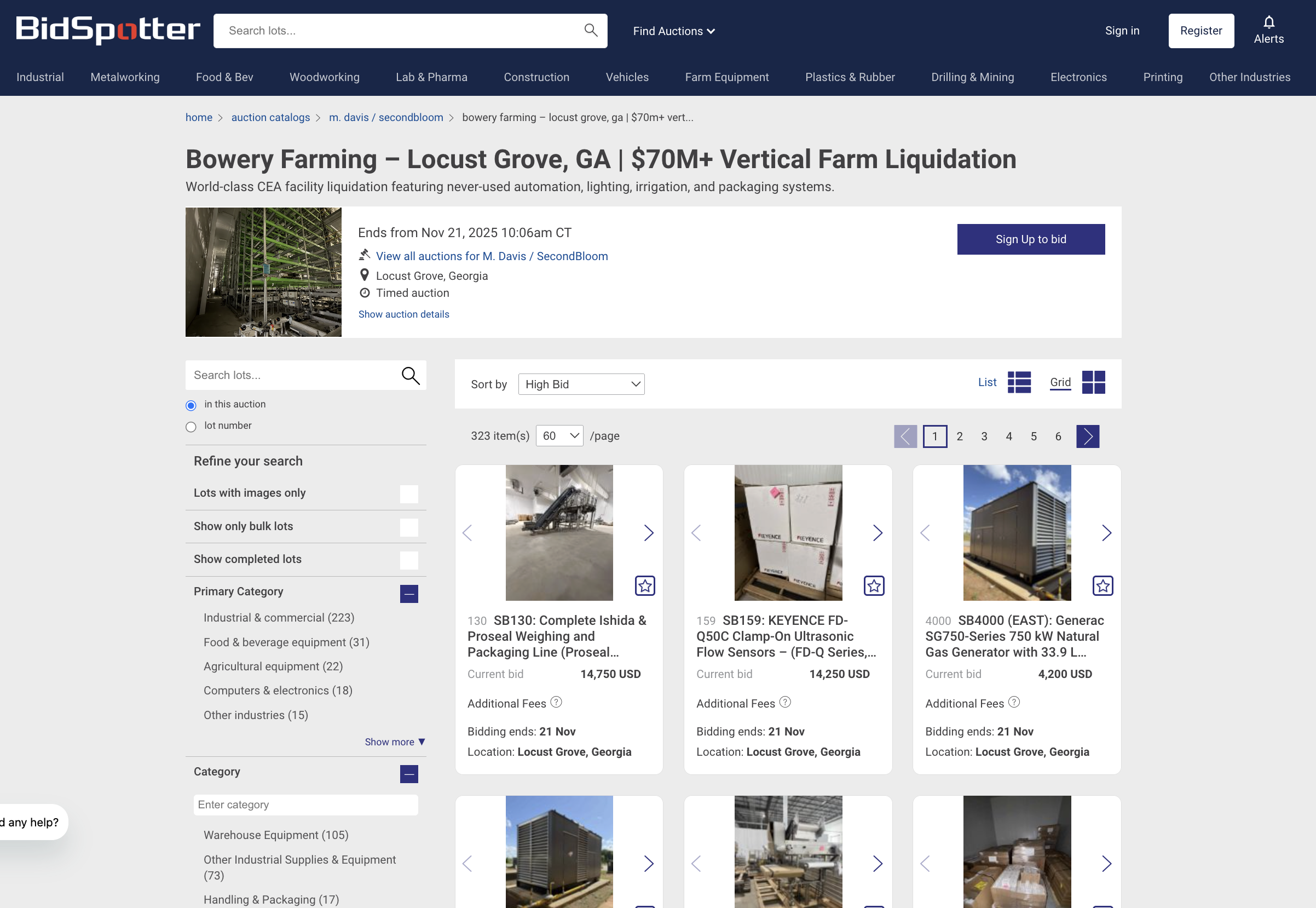

As a next step in a dramatic Bowery Farming’s unwinding, SecondBloom Auctions will liquidate the company’s never-commissioned $70 million vertical farming facility in Locust Grove, Georgia, offering more than 250 lots of modern equipment at deep discounts. The sale marks one of the largest vertical-farming asset disposals in industry history—and comes amid cascading closures and auctions tied to Bowery’s broader collapse.

Bowery Farming, once valued at $2.3 billion and backed by celebrities including Natalie Portman and Justin Timberlake, ceased operations at the end of 2024 after months of financial strain, rising operating costs, and an inability to secure new funding. The shutdown triggered waves of layoffs across its U.S. footprint and forced the company into an Assignment for the Benefit of Creditors (ABC) process managed by Sherwood Partners. The liquidation of the Georgia facility is the largest to date.

A high-profile farm collapses behind the scenes

Bowery’s downfall shocked the controlled-environment agriculture (CEA) industry. Founded in 2015, the company positioned itself as a technological leader with its proprietary BoweryOS automation system and built several large-scale indoor farms in New Jersey, Maryland and Pennsylvania. In 2022, Bowery opened its flagship smart farm in Bethlehem, Pennsylvania, as it pursued national expansion—announcing new builds in Atlanta and Dallas–Fort Worth.

But by late 2024, the company was reportedly out of cash. According to internal documents cited by Pitchbook, Bowery stopped operations immediately, laying off 187 workers and shuttering facilities in Maryland and Pennsylvania. Despite raising over $700 million in venture capital and taking on $150 million in debt from KKR in 2022, Bowery was unable to secure a buyer.

The broader vertical-farming market has suffered similar turmoil: AeroFarms, AppHarvest and others filed for bankruptcy in 2023 and 2024 as high energy prices, supply-chain pressures and cooling consumer demand strained their operations.

Nationwide auctions follow Bowery’s closure

The SecondBloom auction in Georgia is not the only asset sale tied to Bowery’s collapse. Earlier this year, Rosen Systems announced a March 2025 auction of new, unused equipment from Bowery’s planned but never completed Arlington, Texas expansion.

The Rosen sale includes pallet conveyor structures, LED lighting systems, filtration and water-recycling equipment, climate control technologies, packaging lines, and other smart-farm infrastructure originally intended for a Texas site whose agreement with the city was terminated in late 2023.

Together, the Texas and Georgia auctions represent a massive dispersal of vertical-farming assets from what was once the largest indoor-farming company in the United States.

Inside the $70 million Georgia liquidation

SecondBloom’s liquidation of Bowery’s 200,000-square-foot Locust Grove facility includes more than $32 million in never-used equipment, all professionally installed and tested but never brought online.

Key categories include:

- Automation & Material Handling:

Logiqs AS/RS carrier systems (>$5M contract), FlexSpace high-density racking and control systems, full industrial wiring and power distribution. - Irrigation & Fertigation:

Stolze automated nutrient delivery systems, CIP skids, ozone and filtration equipment, Hydrovar pump systems and sensor suites. - Lighting & Climate:

Fluence RAZR LED spectrum fixtures (> $3M), DuctSox air distribution, Nussun circulation fans, and multiple 130-ton Daikin rooftop HVAC units. - Processing & Packaging:

Tri-Mach conveyors, TOMRA optical sorters, TTA transplanters, Urbinati seeders and Proseal tray sealing systems. - Facility Infrastructure:

Stainless steel fabrication, cold rooms, and complete office furnishings.

Chris Lange, President of SecondBloom Auctions, called the Georgia facility “the pinnacle of vertical-farming technology,” noting that demand from international buyers is expected to be strong.

Liquidation Schedule

- Preview (Premium Members): Nov 17–18, 2025

- Online Sale: Early Nov – Nov 21, 2025

- Equipment Removal: Dec 1–18, 2025

- Buyer Premium: 18%

A cautionary moment for the vertical-farming industry

Bowery’s rapid ascent—and equally swift fall—has become a central case study in the risks of capital-intensive indoor agriculture. Its collapse, now visible through dueling liquidation events in Texas and Georgia, underscores the financial and operational headwinds facing the sector, from high energy prices to uncertain retail demand.

For buyers, however, the sell-offs present rare opportunities: commercial-grade, next-generation CEA systems and automation technology—much of it never used—are entering the secondary market at unprecedented discounts.

Enjoyed this story?

Every Monday, our subscribers get their hands on a digest of the most trending agriculture news. You can join them too!

Discussion0 comments