Windfall Bio’s Josh Silverman: ‘We are transforming methane from a cost into a revenue stream’

Methane emissions from agriculture and other diffuse sources are one of the most potent and under-addressed drivers of climate change. According to the International Energy Agency, methane is responsible for roughly 30% of the increase in global temperatures since the Industrial Revolution. While it persists in the atmosphere for a shorter time than carbon dioxide, it is more than 80 times more powerful at trapping heat over its first 20 years.

We had an opportunity to discuss how this situation could be changed with Josh Silverman, the co-founder and CEO of Windfall Bio, a company that targets this problem at its source.

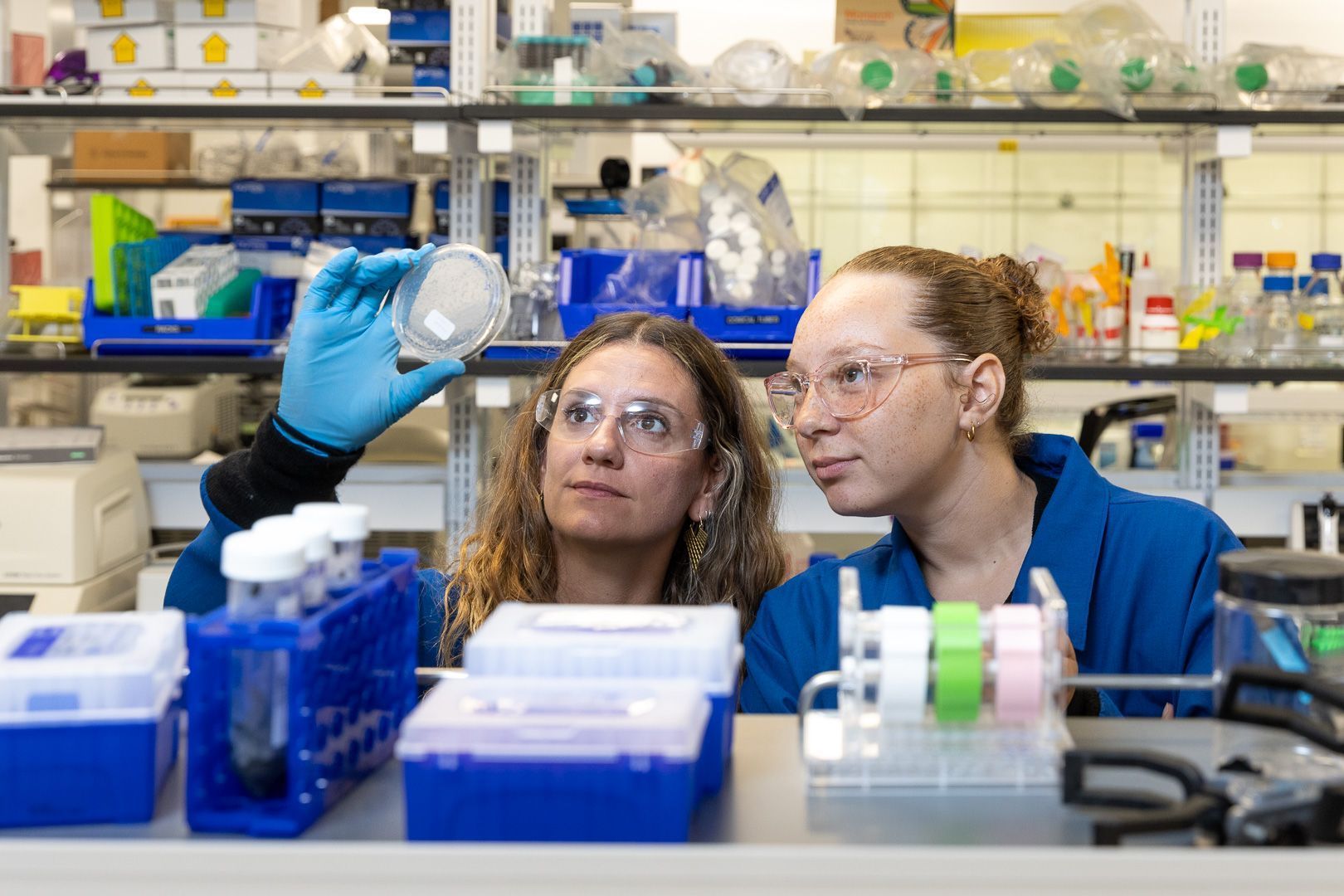

JS: Thank you for having me. At Windfall Bio, we transform waste methane into value. We’ve developed a novel, nature-based solution that harnesses natural microbes, known as mems, to convert methane from any source and at any concentration into valuable outputs, such as high-value organic fertilizer and improved air and soil quality.

When it comes to agricultural practices and modern farming, we are transforming methane from a cost into a revenue stream, positively impacting the entire supply chain. Methane is a waste product from a variety of industries, and Windfall’s technology allows it to be transformed into high-value organic fertilizer that can be used on local farms to save money and avoid fertilizer supply chain disruptions. At the same time, the fertilizer produced is a drop-in replacement that provides high nitrogen availability and better performance compared to similar products such as feather meal.

FD: Your platform uses “mems” — naturally occurring methanotrophs — to convert methane into nitrogen-rich biomass. To what degree have your microbial consortia or process design evolved since founding, and what are the main technical bottlenecks you’re working to overcome?

JS: Windfall has developed a proprietary consortia of natural, non-GMO mems which are extremely effective at consuming methane under a variety of conditions while also providing highly bioavailable nitrogen. However, the process design for converting methane varies based on the source and volume of methane available – the type of equipment needed to convert methane from a dairy farm is different from that needed at a landfill, for example.

Windfall has validated multiple biofilter formats that are appropriate for a range of different methane sources and is currently working with customers across a wide range of industries to deploy commercial solutions for fertilizer production. In terms of technical bottlenecks, we have derisked most of the major hurdles and recently set up a public demo plant in Houston, Texas, as a proof point for customer engagement.

FD: Your recent field trials showed that FOUNDATION, Windfall’s methane-derived organic fertilizer, increased Romaine lettuce yields by 23–34% compared to feather meal. How do you interpret these results in terms of agronomic performance, and what’s next for field validation across other crops?

JS: These results support the highly bioavailable nature of the nitrogen in FOUNDATION compared to feather meal and demonstrate the rapid and efficient mineralization rates. The data show that FOUNDATION performs equivalently to 16-0-0 pure amino acid products, which currently sell at significant premiums relative to feather meal and other similar products. In addition, FOUNDATION is non-animal-derived and inherently pathogen-free, giving it a significant safety advantage over most organic fertilizers.

Our grower partners have been extremely enthusiastic about the current results, and Windfall expects to continue working with them through commercial deployments. Importantly, FOUNDATION is currently marketed as a drop-in replacement based on measured NPK values, so additional field-trial validation across more crops is not necessary. Our current efforts are focused on formulation and delivery to ensure compliance with fertigation systems and specific application systems.

FD: FOUNDATION recently earned OMRI certification, opening the door to organic farmers. How significant is that milestone for your go-to-market strategy, and how are you engaging with organic growers?

JS: This certification unlocks a key market for our FOUNDATION fertilizer in being certified for organic use under the USDA National Organic Program (NOP) standards. It also represents a major step forward in redefining what fertilizer can be, and that’s safer, cleaner, and better for both the soil and the climate.

There’s a rapidly growing market that increasingly demands sustainable, effective alternatives to synthetic fertilizers, and we are ready to provide it with a solution. We continue to deepen our engagement with organic growers and are providing large samples of our fertilizer product to interested partners; however, in the long term, we are focused on providing a cost-effective solution for non-organic farmers seeking higher-quality, non-synthetic fertilizers.

FD: You have mentioned that you are building a demonstration plant in Houston. Can you discuss the scale, expected throughput, and the types of methane feedstocks (e.g., landfill gas, flare gas) you plan to run through that facility?

JS: I’m excited about the opening of our commercial-scale demonstration facility in Houston, Texas. This new facility serves as a real-world showcase of our modular bioreactor system, and we welcome and encourage visitors and customers to observe its engineering feasibility, operations monitoring, and value capture in a continuous commercial environment.

The plant is designed to handle blends of methane feedstocks, including oil and gas flares, coalbed methane, landfill gas, and biogas. It is equipped with Windfall’s proprietary software and operations platform, which enables remote monitoring, AI-driven insights, and real-time performance feedback.

FD: Beyond fertilizer, are there additional value streams you envision from the bioconversion process, like, for example, carbon credits, soil amendments, or other specialty products?

JS: Yes. Across industries, our business model incorporates carbon credit revenues resulting from avoided emissions and methane abatement reporting. Other value-added benefits include improved air quality—particularly for the landfill use case, where operators seek to mitigate odors and other volatile organic compounds—and enhanced soil quality.

FD: Windfall is active in the waste and landfill sector, including a trial at the Sunshine Canyon landfill. What have you learned from that deployment about scalability, regulatory barriers, and financial viability?

JS: Yes, we recently deployed our biocover technology in a field trial at Republic Services’ Sunshine Canyon Landfill (SCL), as well as additional trials which have not yet been publicly disclosed. We are pleased to report that a single application of our mems at SCL achieved an over 75% reduction in methane emissions, in which the mems consumed at that rate for more than 30 days.

Additionally, the mems demonstrated over 99% degradation of representative VOCs, covering more than 80% of odorous and potentially harmful compounds identified in SCL gas. This deployment validates Windfall’s mems biocover as a low-capex solution for landfill operators to easily address odor and air quality concerns, meeting regulations in a financially viable, low-complexity, minimal-practice-change way. We are further exploring the use of biocover as a highly attractive method for generating carbon credits, which could yield significant profits for applications in this space.

FD: Looking globally, which markets beyond the U.S. are most promising for your methane-to-fertilizer technology — both in terms of methane sources and agricultural demand?

JS: Beyond the U.S. market, Windfall is active in Australia, Canada, the U.K., Ireland, Mexico, and Brazil, among other regions, and with more regions to come. We are currently developing over 20 projects across various industries, ranging from energy (oil & gas, coal) to waste management (landfills, wastewater treatment) to agriculture and food (dairy, beef, hog, poultry, and food processing).

FD: Can you give us a status update on your current financing: your latest round, cash runway, and whether you’re planning to raise further capital in the near term? What scale-up milestones would you like to hit before a new fundraising round?

JS: Sure, we have raised $37 million in total funding to date since founding in 2022 and are fortunate to have the backing of leading climate and technology investors, including Breakthrough Energy Ventures, Amazon’s Climate Pledge Fund, Mayfield, Prelude, Cavallo (Wilbur Ellis), and Untitled, to name a few. We are actively raising capital to support our commercialization and deliver the product to our customers.

FD: As you scale manufacturing and deployment, how do you plan to balance capital intensity (e.g., bioreactors) with your strategy to remain cost-competitive against both synthetic and organic fertilizers?

JS: Windfall’s business model is focused on capital-light deployment, leveraging contract manufacturing to provide mems to our customers cost-effectively at scale. In terms of methane conversion, bioreactor systems are significantly cheaper to build and operate than traditional methane monetization technologies, such as renewable natural gas (RNG) or electricity generation.

Our current approach is to work with current developers in these industries, who are experienced in building and operating methane capture systems, and offer them an economically attractive alternative to their traditional deployments for converting methane to value. Since waste methane is cheap, and bioreactors are significantly lower in capital costs, the economics of our process allow for competitive pricing with nonsynthetic fertilizers even before taking into account FOUNDATION’s proven performance advantages.

Given the lower nitrogen content and differing use cases compared with synthetic fertilizers, we do not expect to compete head-to-head with them in the near term. However, as we continue to scale and achieve further reductions in capital, and as we react to supply chain disruptions and trade headwinds, we see long-term opportunities to become a viable alternative to synthetics, especially in areas that value downstream benefits such as water and soil quality.

Enjoyed this story?

Every Monday, our subscribers get their hands on a digest of the most trending agriculture news. You can join them too!

Discussion0 comments