Friday’s Insider: Fertilizer affordability — December update and year-end comparison

Happy 2025 to everyone! As we step into the new year, it’s time to reflect on December prices to evaluate how fertilizer affordability has shifted towards the end of 2024. By comparing urea and DAP prices with corn and wheat values, we can assess how affordability evolved and how December contrasts with November.

Key inputs: December vs. November

Here’s how the numbers compare:

- Corn Price: $4.54 per bushel (up from $4.38 in November)

- Wheat Price: $5.48 per bushel (down from $5.57 in November)

- Urea FOB NOLA: $330 per short tonne (up from $310 in November)

- DAP FOB NOLA: $575 per short tonne (up from $570 in November)

These changes highlight rising fertilizer costs against diverging trends in crop prices. Let’s dive into the affordability ratios and their implications.

Affordability ratios across 2024

Affordability is calculated as the ratio of crop prices to fertilizer prices, providing a clearer understanding of the cost burden on producers.

Urea affordability

- Corn Producers:

- June: 0.0146

- July: 0.0145

- August: 0.0141

- September: 0.0138

- October: 0.0141

- November: 0.0141

- December: 0.0138

Analysis: Affordability for corn producers declined slightly in December as urea prices rose faster than corn prices. The ratio reflects the increasing cost burden compared to November.

- Wheat Producers:

- June: 0.0177

- July: 0.0176

- August: 0.0173

- September: 0.0171

- October: 0.0171

- November: 0.0179

- December: 0.0166

Analysis: Wheat producers saw a drop in affordability as wheat prices fell and urea costs increased, reflecting tighter margins.

DAP affordability

- Corn Producers:

- June: 0.0079

- July: 0.0078

- August: 0.0076

- September: 0.0073

- October: 0.0073

- November: 0.0073

- December: 0.0072

Analysis: Corn producers experienced a slight decline in affordability due to the modest $5/tonne increase in DAP prices.

- Wheat Producers:

- June: 0.0098

- July: 0.0097

- August: 0.0095

- September: 0.0093

- October: 0.0093

- November: 0.0096

- December: 0.0095

Analysis: Affordability for wheat producers remained relatively stable, reflecting the balance between slightly higher DAP prices and falling wheat values.

Comparison to November

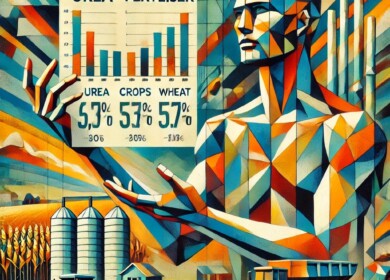

- Urea:

- Corn producers: Affordability dipped marginally from 0.0141 in November to 0.0138 in December.

- Wheat producers: Affordability declined from 0.0179 to 0.0166, with falling wheat prices amplifying the cost pressure.

- DAP:

- Corn producers: Affordability moved slightly from 0.0073 in November to 0.0072 in December.

- Wheat producers: Affordability remained relatively steady, moving from 0.0096 in November to 0.0095 in December.

Analysis of trends

Urea: December highlighted the rising cost of urea relative to corn and wheat. Corn producers bore slightly higher costs, while wheat producers faced additional pressure from declining crop prices.

DAP: Affordability ratios for both corn and wheat producers showed minimal change, reflecting the modest increase in DAP prices.

Concluding thoughts

December’s affordability ratios reveal modest declines for both urea and DAP. Here’s the takeaway:

- Urea: Affordability worsened slightly, particularly for wheat producers due to falling prices.

- DAP: Affordability remained stable, reflecting smaller price changes in both fertilizer and crops.

As we move into 2025, these trends emphasize the importance of careful planning and market monitoring to mitigate rising fertilizer costs. Like always, keeping an eye on these affordability ratios will be critical for producers navigating towards the application season.

————

About the Author of “Friday’s Insider”: Ilya Motorygin is the co-founder of GG-Trading and brings 30 years of experience to the fertilizer industry. Renowned for his comprehensive problem-solving skills, Ilya expertly manages deals from inception to completion, overseeing aspects such as financing, supply chains, and logistics.

Enjoyed this story?

Every Monday, our subscribers get their hands on a digest of the most trending agriculture news. You can join them too!

Discussion0 comments